The Best Strategy To Use For Opening Offshore Bank Account

Give offshore banking to a higher or lower level. Some overseas territories have actually steered their financial industries away from offshore banking, believing it was tough to correctly control as well as accountable to offer rise to financial rumor.

4 Easy Facts About Opening Offshore Bank Account Explained

Similar to a criminal utilizing a wallet determined and taken as profits of criminal activity, it would certainly be counterproductive for any individual to hold possessions unused (opening offshore bank account). In addition, a lot of the funding streaming through cars in the OFCs is aggregated investment resources from pension funds, institutional as well as personal capitalists which has actually to be deployed in market around the globe.

Offshore banks give accessibility to politically and economically steady territories. This will be a benefit for homeowners of locations where there is a risk of political chaos, that fear their assets might be frozen, seized or vanish (see the for instance, throughout the 2001 Argentine economic dilemma). Nonetheless, it is additionally the situation that onshore financial institutions use the exact same advantages in terms of stability.

Examine This Report about Opening Offshore Bank Account

In 2009, The Island of Male authorities were keen to point out that 90% of the plaintiffs were paid, although this just referred to the number of individuals who had actually gotten cash Website from their depositor compensation scheme as well as not the quantity of cash reimbursed.

Only offshore centres such as the Island of Male have actually rejected to compensate depositors 100% of their funds following bank collapses. Onshore depositors have been refunded in complete, regardless of what the settlement limitation of that nation has mentioned. Thus, financial offshore is historically riskier than financial onshore.

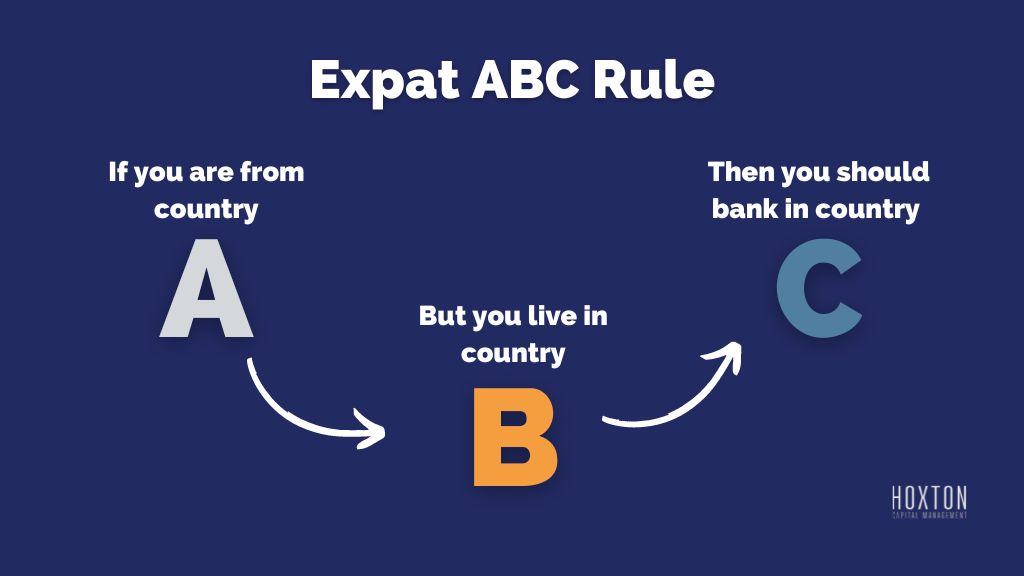

Offshore financial is a reputable economic service utilized by many expatriate and also global workers. Offshore jurisdictions can be remote, and also consequently costly to visit, so physical accessibility can be tough. Offshore personal financial is generally more easily accessible to those with greater incomes, because of the expenses of developing as well as maintaining offshore accounts.

Fascination About Opening Offshore Bank Account

The tax problem in developed nations therefore falls disproportionately on middle-income groups. Historically, tax obligation cuts have tended to result in a greater percentage of the tax obligation take being paid by high-income teams in increases from time to time, as previously protected revenue is brought back right into the mainstream economic climate.

24). Area Court situation in the 10th Circuit might have significantly increased the interpretation of "rate look at here now of interest in" and company website "various other Authority". Offshore bank accounts are occasionally touted as the option to every legal, monetary, and possession security method, however the advantages are frequently exaggerated as in the a lot more prominent jurisdictions, the degree of Know Your Customer proof needed underplayed.

This tax influences any type of cross border rate of interest settlement to an individual citizen in the EU. The price of tax obligation deducted at source has risen, making disclosure significantly eye-catching. Savers' option of action is complex; tax authorities are not prevented from enquiring right into accounts previously held by savers which were not after that divulged.

See This Report about Opening Offshore Bank Account

Projections are commonly asserted upon levying tax on the capital amounts held in offshore accounts, whereas most nationwide systems of taxation tax revenue and/or resources gains instead than accumulated wide range.